- Over 44% of global companies have shifted from an in-office setup to a remote setup in the last 5 years. Making 16% of them turn to fully remote firms.

- Around 28% of the Global Workforce comprises tax-paying remote workers. With nearly 22.8% of this workforce working for US companies.

- Different types of Remote Workers pay their taxes differently. And knowing the process can help in managing the finances better.

Remote working has become the new norm — opening doors to hundreds of opportunities for global workers. Now, literally anyone can work from any location with a remote job.

However, with remarkable benefits come complicated responsibilities. And, paying your taxes while working remotely is the most complicated one.

Moreover, most traditional taxation resources have no guidance on how to manage taxes if you are working out of the office cubicle. Therefore, it becomes challenging to manage your finances while avoiding penalties.

So, if the question still bugs you — “If I work remotely, where do I pay taxes?” Your remote buddy is here to save the day.

In this blog, I have delved into —

- How remote working taxes work,

- Whether you need to pay local taxes,

- How different remote workers pay their taxes,

- And, some tips to help you through the process.

Stay tuned!

How Do Remote Working Taxes Work?

Unlike the traditional taxation system for in-office workers, the remote work taxation process is quite complicated. It depends on a lot of factors, like —

- Employer company’s location

- Employee’s residency and location

- The time an employee spends working remotely at a specific location

Moreover, the entire tax implication differs from state to state. So, you need to be aware of your local and foreign tax laws.

In addition to this, you need to have a comprehensive idea about the tax implications of the state where your company is located.

By having a complete knowledge of the laws from different states, you can understand how your income tax implication works.

Based on whether you have to pay taxes in both the countries — where you reside and where you work — you can decide to relocate to a low tax rate state.

Do You Pay Local Taxes If You Work Remotely?

It completely depends on your local income tax laws in your locality, where you are working remotely from.

Therefore, it is important to know the laws properly before choosing to work remotely from anywhere.

So, if there is such a law, then, yes, you will have to pay the taxes while living and working remotely from that place, even if your company is based outside.

How Do Different Types Of Remote Workers Pay Taxes?

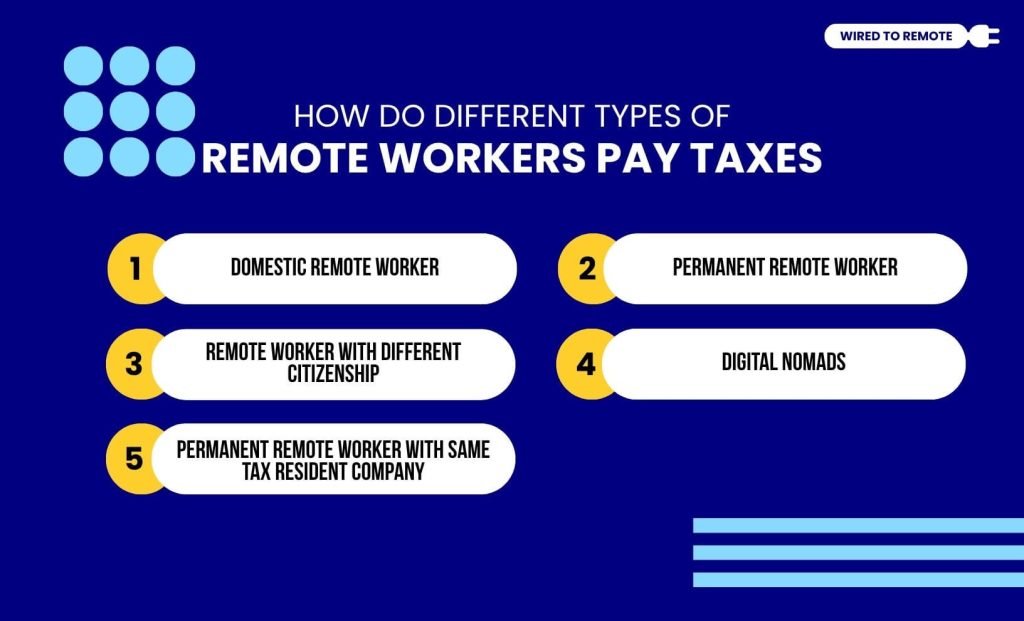

Given that there are different types of remote working available, there is no single distinct process for tax implications. For different types, different tax implications are mentioned.

So, here I have delved into the basic 5 types of remote working and how taxes work for these roles. But, to simplify the process, I have considered only the full-time roles.

1. Domestic Remote Worker

Domestic remote worker refers to those employees who work remotely for a local company while residing in the same country. So, basically, earning while staying at home.

Now, in the context of tax implications, their income tax is deducted by the local company while rolling out their regular paychecks.

Therefore, by the end of the year, they need to file their income tax return declaration. Complying with the resident tax laws.

2. Permanent Remote Worker

As a permanent remote worker, they stay in their home country while working for foreign companies. So, they, as well as their foreign employers, need to comply with the resident country’s laws.

Given that they are completely residing in their home country, the employers need to pay them according to the local employment standard laws.

So, as a permanent remote worker, if you are working for an MNC, you will be paid under the local subsidiary in your country.

In addition to this, you will be set under an EOR (Employer of Record). So, your EOR acts as your employer in your home country.

Therefore, your EOR will help you with the tax implication process and deduct the tax while rolling out your paychecks. Ensuring that you stay compliant with the laws.

3. Remote Worker With Different Citizenship

Now, there is another type of remote work, where the worker is residing in a different country and working for a foreign company.

That is, if you are a US citizen and residing in France while working for a UK company, then you fit into this category.

So, their tax implications are the most complicated ones. Firstly, they are supposed to pay income taxes in the country where they are residing and working.

However, they also need to consider the tax implications in their country of origin (Citizenship-Based Taxation), if there are any. Based on that, they might have to pay double taxes.

In the US, you have to file your tax return with the IRS even if you are not earning from a US-based company. Additionally, you get the Foreign Tax Credit that basically deducts your abroad taxes.

So, you get to reduce the tax in your origin country by showing that you have already paid quite an amount to your country of residence.

And, honestly, these laws help expat communities to live abroad while working for foreign companies.

4. Digital Nomads

Well, you might think, the previous category was digital nomads. However, there is a small difference between digital nomads and expats.

As the name suggests, digital nomads live a nomadic lifestyle — changing their location every three to six months.

However, expat communities stay at a specific place for more than a year and so. That is, they reside in a different country, either temporarily or permanently.

So, naturally, they need to file the tax return to their residential country — the place where they have direct ties, like:

- A house or apartment,

- Family or spouse and children,

- Bank accounts and personal property.

Now, as a digital nomad, you need to declare your entire worldwide income. So, you need to include both your home and abroad incomes.

In addition to this, if you have stayed over 182 days or half the year in a country, you are entitled to declare your income there.

And, you should also report your tax income to your origin country as well as your present country of residence.

Moreover, there might be issues with double taxation. For that, you will need to know about your resident country’s tax treaties.

Based on that, you will know which country you need to declare your income tax, and what tax reductions you will get. So, make sure you have a comprehensive knowledge of the treaty.

5. Permanent Remote Worker With Same Tax Resident Company

In this last type of remote working, workers basically work for a company that is located in their home country while residing in a foreign country.

That is, if you are a US citizen, working for a US company, but residing in the UK, you belong to this category. So, you will have a set of special tax obligations.

Looking at the bigger picture, it looks like domestic remote working, where your local employer is paying you.

However, given that you are residing abroad, you need to file the declaration with the country of residence, while keeping your origin country in the loop.

Without the proper information about your origin country, you might incur additional taxation. And, sometimes even your tax can be withheld.

Things To Keep In Mind While Paying Taxes As A Remote Worker

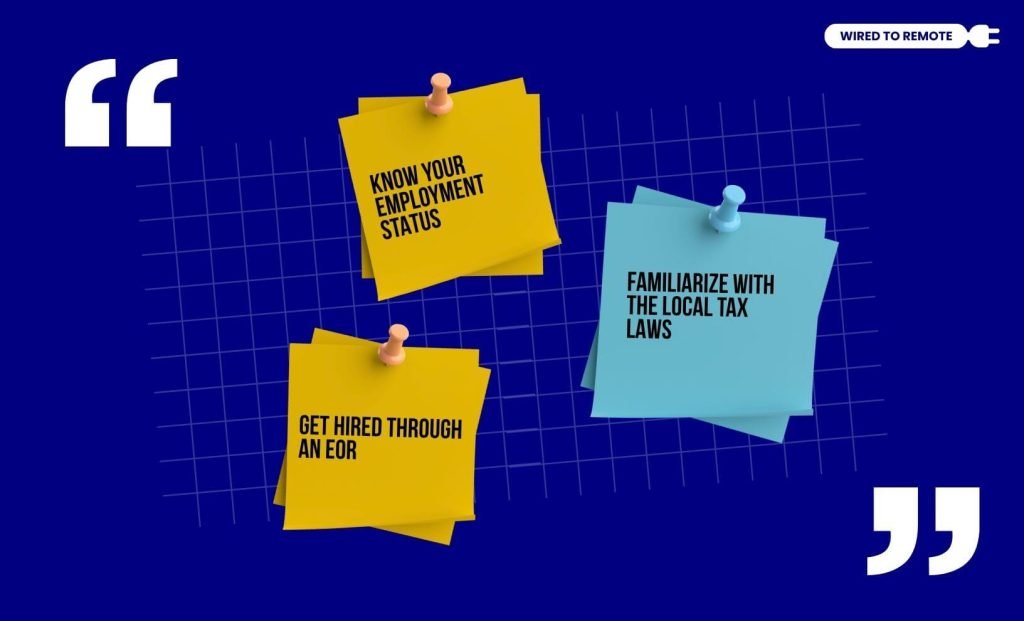

Now that you have the complete answer for — “If I work remotely, where do I pay taxes?” You need to keep a few things in mind to ensure you comply with the tax implications.

- Know Your Employment Status — Instead of guessing and assuming your employment status with the remote company, you need to clarify the status.

So, based on whether you are a full-time, part-time, or contractual employee, you can understand how you fall under the tax implications.

- Familiarize With The Local Tax Laws — Apart from your employment status, you need to have a comprehensive idea about the tax and employment laws in your country of residency.

So, when you have a clear knowledge of the local laws, you can work with a professional and navigate through the process easily.

- Get Hired Through An EOR — Also, you should ensure that you get hired through an EOR. When you work with them, you can easily comply with the tax regulations.

By following these few tips, you can easily navigate the entire process of taxation and file your declarations with the right countries. So, get the correct knowledge and start living your remote lifestyle with ease!

FAQs

When you are working remotely, you pay the state income taxes for the specific state where you are located. However, different states have different tax implications. So, you need to have a clear knowledge of the tax laws in your state.

Yes, absolutely. You can work remotely for a US company while living abroad. However, you need to check the company policies.

And, check whether they open roles to remote workers outside of the US. Additionally, clarify your employment, visa requirements, and tax implications before joining the firm.

If you are an EU resident and work outside of Europe remotely, you need to pay taxes only for the state where you are residing. So, you will not fall into the tax implications of Europe.

However, if you are working remotely while staying in Europe, you need to pay your local tax in the country where you are living.

Yes, you can work remotely from other countries on US payroll. However, you need to have valid certificates proving that you have the authority to work in both your country and the US.

Yes, you need to declare all your income. Whether your income is sourced from foreign countries or from the home country, you need to provide the proper declarations.

However, if you are not a citizen of the resident country, you might not have to declare your foreign income to the country. So, make sure you know the proper laws.

Leave A Comment