- Health insurance provides the financial support to individuals by covering their medical expenses during times of emergency.

- Health insurances for remote workers are designed specifically to support remote employees by covering healthcare facilities in diverse locations. So, they can access them while working from any location.

As remote work is becoming popular, employees are shifting to this new corporate culture to enjoy working from diverse locations.

But with the hustle of remote working comes unexpected medical emergencies and physical injuries. Forcing workers to seek medical assistance.

And, covering the massive medical bills can financially drain anyone. That’s where health insurance comes to save the day.

It provides financial support during emergency times to manage medical expenses. So, by covering the medical bills, the health insurance reduces the financial burden.

But regular health insurance cannot provide the financial protection to remote workers. Given that they reside in different locations, they need nationwide health insurance coverage.

So, an insurance plan tailored specially for remote workers can help in maintaining employee well-being and overcoming financial hardships.

But the question is— “How to choose the health insurance for remote workers?” Well, no need to worry, your remote buddy is here.

In this blog, I am going to explore the various aspects of remote work health insurance by delving into—

- Its importance and coverage details,

- Factors affecting it,

- Options available to remote workers, and more.

So, come dive right in!

Why Do Remote Workers Need Health Insurance?

Among all the types of workers, remote workers need health insurance the most.

Since they reside in various locations, they need health insurance to access healthcare services in diverse places.

Moreover, health insurance for remote workers ensures that the employees can get healthcare access while residing in one country and working for another.

So, they can get financial support across borders.

How Does Health Insurance Coverage Differ For Remote Work?

Unlike regular health insurance, remote-friendly ones come with a few special policies that aid remote workers in accessing financial support from diverse locations. Some of these include—

- Specific State Regulations: Firstly, health insurances for remote workers are tailored based on the specific state regulations where they are residing. So, they can get the financial support in that particular state.

- Access To Diversely Located Healthcare: Moreover, the health insurance will cover specific networks of healthcare facilities in diverse locations, where the workers are located. So, they can access healthcare without any difficulties.

- Portable Health Insurance Plans: In addition to this, these health insurance plans are portable. That is, they can be used and transferred across borders as the remote worker travels to different locations.

According to the Reddit comment on how health insurance for remote workers works—

“Most plans are state-based, but if your company regularly uses remote workers, they MAY choose to offer a nationwide plan. If not, or if they only have a few out-of-state remote workers, a remote worker can purchase their own state-based individual plan, which the company will pay their portion”.

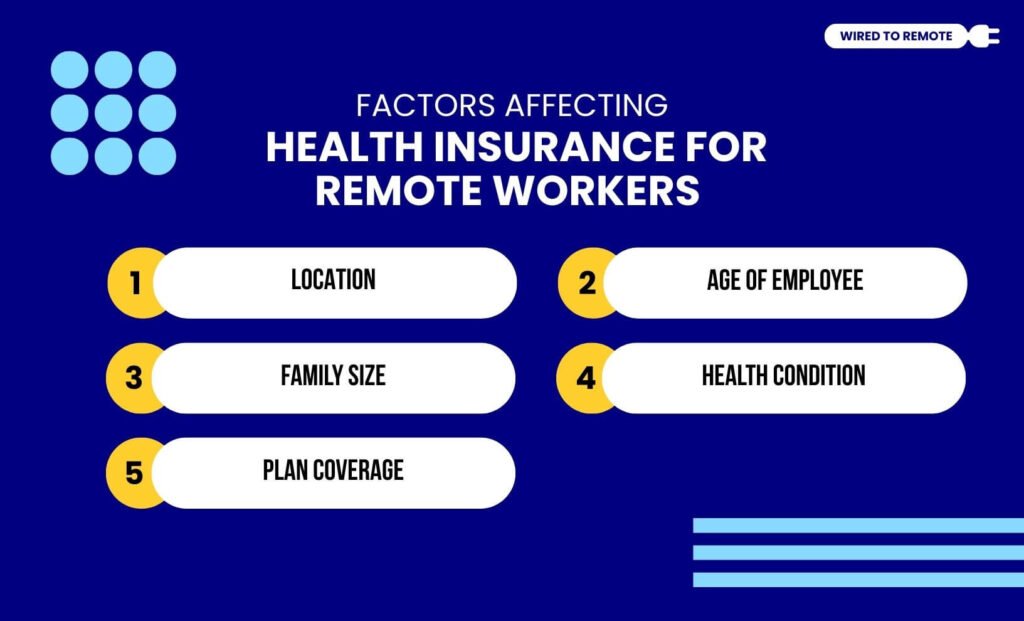

Factors Affecting Health Insurance For Remote Workers

Several factors affect the cost of health insurance plans for remote workers. Making them either expensive or cheaper. So, here are some of the common factors—

- Location: Due to the difference in the healthcare costs in different countries, location affects the pricing of the insurance plan.

- Age Of Employee: Additionally, the age of the worker determines the cost of the plan. So, if the employee is under the age of 40, they can avail cheaper health insurance options.

- Family Size: Also, the number of family members, depending on the worker, plays a crucial role in deciding the cost. So, bigger families need to opt for expensive plans compared to single people.

- Health Condition: Moreover, the physical and mental health condition of the worker is an immediate factor in determining the plan cost. So, having pre-existing health conditions can make the plans more expensive.

- Plan Coverage: Finally, the comprehensive coverage of the plan determines the cost. That is, if the plan covers fewer benefits and minor injuries, then it will be cheaper compared to extensive coverage plans.

What Health Insurance Options Do Remote Workers Get?

Since remote employees work from different locations, they get health insurance options based on their employment status, income, and location.

1. Employer Sponsored

Firstly, remote workers can get health insurance that is fully sponsored by their employer as part of their benefits package. So, the workers can get better coverage with lower premium plans.

According to the comment of a remote worker on Reddit on how employer-sponsored health insurance works—

“Generally speaking, your employer offers a couple of different plans that vary between cost and coverage, and then you pick one. Then you find a nearby doctor that is in your network and accepts your insurance”.

2. Individual Health Insurance

But if there are no employer-sponsored plans provided, then remote workers can opt for the individual health plans. So, by availing these through the Health Insurance Marketplace, workers can directly choose their plans from the insurers.

3. State Health Insurance

Moreover, the Affordable Care Act (ACA) ensures that all states provide a health insurance marketplace. So, remote workers can explore these marketplaces in their residing states to buy affordable plans with reasonable coverage.

4. COBRA Coverage

Finally, if the worker previously had company-sponsored health insurance, they can opt for the COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage. This way, they can continue the coverage for a limited time after quitting the job.

Challenges Of Health Insurance For Remote Workers

Even though remote work provides flexibility, there are certain unique health insurance challenges. Some of them include—

- Finding affordable coverage for freelancers and independent contractors.

- Accessing healthcare beyond the network covered by the plan.

- Navigating through diverse state regulations around insurance policies.

- Maintaining the coverage plan while working for different companies.

Things To Keep In Mind While Getting Remote Health Insurance

Having health insurance for remote workers can be quite beneficial while working from different locations. So, workers can get financial support during emergencies.

But choosing one from the countless options can be difficult. So, here are some things to consider before finalizing the insurance plan—

- Comparing a couple of insurance options before settling for one.

- Checking the specific details and coverage areas under the plan.

- Ensuring the compliance of the plan with the state regulations.

Now, with this complete guide on health insurance, remote workers can get the best financial support. So, what’s the wait for? Go ahead and grab the most beneficial and affordable one today!

FAQs

Generally, ESI automatically covers the medical expenses once the worker joins the company. But group health insurance needs to be separately enrolled to avail its benefits, which can be time-consuming and expensive.

Some of the best insurance for digital nomads include –

• SafetyWing

• World Nomads

• Cigna Global

• Genki

• Insured Nomads.

Some of the factors that remote workers should consider before choosing health insurance include –

• Coverage benefits and healthcare network details.

• Affordability and cost of the plans.

• Reliability of the insurance company.

• Aging and pre-existing health conditions.

• Policy terms and no-claim bonuses.

Leave A Comment