In this era, having an international bank account is no longer a luxury; it is a necessity for most digital nomads.

Since they reside and work across the borders, they need to manage their finances without letting the barriers come in between.

With the traditional banking institutions, you are charged extra for withdrawals, transfers, or even currency exchanges. Making the entire banking system difficult.

However, with the international banking systems, you can easily manage these processes. So, managing your finances the right way becomes a piece of cake.

But do all the international banks provide the same benefits and facilities? To be honest, no. Different banking systems have different provisions.

Depending on your nationality, tax residency, accommodation plans abroad, and employment details, the provisions can vary. Limiting your borderless banking options.

So, you need to choose the one that best meets your needs. And, to help you find the best international bank account, I have brought you the ultimate guide.

Here, I have explored the benefits and process of opening an international bank account, along with a list of the top banking institutions.

Stay tuned!

What Is An International Bank Account?

Before looking into the best international banks, let’s understand the function and benefits of an international banking institute.

Unlike regular banking, international bank accounts help you to manage your finances across borders. That is, you can exchange, transfer, and receive foreign currencies.

Moreover, these bank accounts can be accessed remotely. Making them a viable option for digital nomads and remote workers working for foreign companies.

Additionally, you will have all the banking facilities with an international account — multicurrency exchange, ATM access, tax optimization, and cross-border payments.

Traditional Banks Vs International Banks

The key differences between traditional banks and international banks include:

| Traditional Bank Accounts | International Bank Accounts |

|---|---|

| 1. Manage finances within the national border. | 1. Manage finances and funds across national borders. |

| 2. Charges high fees for foreign currency transfers and exchanges. | 2. Reasonable charges for foreign currency exchanges and transfers. |

| 3. Do not support multicurrency transactions. | 3. Supports global transactions with multicurrency. |

Why Do Digital Nomads Need International Bank Accounts?

Given that digital nomads are always travelling to new countries, they need international bank accounts to earn and spend money in more than a single country.

Apart from that, international bank accounts provide many benefits and provisions that can further help expats to manage their finances. Some of these benefits are:

- Managing foreign currency holdings and payments without high transaction fees.

- Providing faster and efficient transactions.

- Remotely accessing banking services from any location.

- Protecting financial assets in different foreign countries easily.

- Managing global tax planning with enhanced financial privacy.

How To Open International Bank Account Online?

With the advancement in digitalization, the international banking system has evolved tenfold. So, opening an account has become much easier than before.

You just need to follow these simple steps.

- Choose the specific bank based on your location, financial needs, and currency support.

- Open the online portal and fill up the account opening application form.

- Provide the digital copies of your important documents and submit the form.

- Complete the KYC (Know Your Customer) process.

- Then, wait for the activation of your account.

- Once it is activated, you can transfer your funds and start using it.

Documents Required To Open An International Bank Account

To digitally set up your international bank account, you will need to provide a few important documents. These will help in your identity and employment verification.

So, keep a digital copy of your:

- Valid passport or any Government ID.

- Residential Proof for your stay abroad.

- Income Proof and Tax Number.

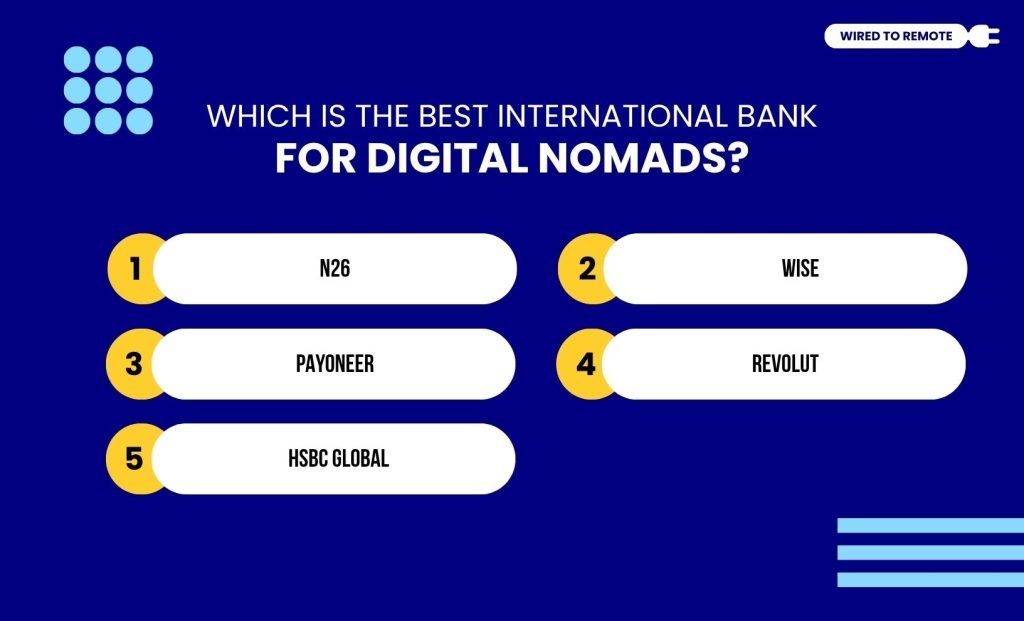

Which Is The Best International Bank For Digital Nomads?

Now that you know how to get started with an internal bank account, here is a complete list of the best international banks for digital nomads.

1. N26

First on the list is N26 with its user-friendly interface and neo-bank features.

It is predominantly used in the European banking market. Enabling fund transfers over the SEPA network.

Moreover, it supports currencies of Germany, Poland, Denmark, Iceland, Norway, Sweden, and many more EU countries.

It is mainly preferred for its free plans that require no monthly or yearly banking charges. So, you get access to the banking services without paying a single dime!

Additionally, it offers countless neo-bank features — Maestro card, Apple and Google Pay, minimum cost investments, and cryptocurrency transactions.

Along with these, you also get travel insurance and interest payments included in their premium plans. Making it an all-in-one banking solution for digital nomads.

2. Wise

If you are looking for a more global fintech platform that supports banking irrespective of the continent, you need to try Wise (Transferwise).

With its transparent low charge policies and huge currency coverage, it has earned the title of “Best Global Fintech” among the nomads.

Moreover, it lets you transfer and exchange funds in 50 different countries with affordable fee rates. So, sending and receiving money across borders is just a click away.

Additionally, its interface is quite user-friendly, so setting up an account won’t be difficult. Just create the account and start using it for international banking.

Along with that, you get great competitive interest on the deposits you make. So, managing your funds in the global market becomes easy.

3. Payoneer

Payoneer has brought a revolutionary change in the SWIFT transfer of traditional banks. So, no more tiresome, slow, and expensive transfer processes.

Moreover, it supports multicurrency transactions with low fee charges. So, you can easily transfer and exchange funds across borders.

Predominantly, it provides banking services for Australia, the UK, the USA, and European countries. So, if PayPal is not your immediate choice, you can always go for Payoneer.

Additionally, it allows you to create your account through its digital portal without needing to visit any branch. Making the entire process of account opening fast and efficient.

4. Revolut

Unlike its competitor, Wise, Revolut started off with a free plan for currency transfer and unlimited exchanges. However, those benefits are long gone.

Now, it provides paid international transfers and a monthly exchange limit of £1,000. Making fund transfers over the SEPA network affordable and smooth.

Moreover, its banking app comes with a lot of features — microsavings, investments, and budgeting — to provide banking services at your fingertips.

Apart from these benefits, it provides data highlighting your transaction history, which can help you with your savings and budgeting plans.

Additionally, it has a special platform, Revolut Pro, that caters to the financial needs of solo business owners. So, you will find plans for all kinds of digital nomads.

5. HSBC Global

Ending the list with the HSBC Global Account, with its free transaction plans and user-friendly interface. Giving you all the banking features without spending a penny.

It offers premium banking services to mainly Australian residents. However, non-residents can apply for the account by visiting its branch.

Moreover, it is preferred over most other banks for its wide range of benefits and multicurrency support.

For instance, it readily allows you to exchange money from 10 different countries — Australia, the USA, the UK, Europe, Japan, China, Canada, Singapore, New Zealand, and Hong Kong.

However, it has a set limit for both ATM withdrawals and card purchases. For free-of-charge cash withdrawals, the daily limit is $2,000, and for card purchases, it is $10,000.

Things To Keep In Mind Before Opening An International Bank Account

Having a superficial knowledge of international banking is not enough to manage your funds responsibly. So, you need to keep a few things in mind before opening an account.

Firstly, based on your location and transactional needs, choose the bank. This way, you will have to pay less amount of money for the service charges.

Secondly, focus more on financial privacy and transactional security. With a reputable bank, you can securely transfer and exchange your money across borders. So, choose wisely.

Finally, learn about the terms and banking policies of your chosen bank for international transactions and multicurrency support.

When you read its terms properly before submitting your application, you get a clear idea about its policies. So, you can avoid unnecessary charges hidden under the fine print.

By keeping these few things in mind, you can open an international bank account easily to manage your foreign funds. So, ready to start? Open an account today and start living your nomadic lifestyle with ease!

Leave A Comment